FCA Financial Lives survey shows – yes – growing interest in ESG

Posted on: September 13th, 2023

July 2023 saw the publication of the FCA’s 2022 Financial Lives Survey, which I have ‘cherry picked’ some key numbers from, but would recommend you read via the links provided 🙂

The document that focuses on consumer responses to ESG and responsible investment questions and trends is the following PowerPoint presentation:

https://www.fca.org.uk/publication/financial-lives/fls-2022-consumer-investments-financial-advice.pdf – the relevant information starts on slide 42 .

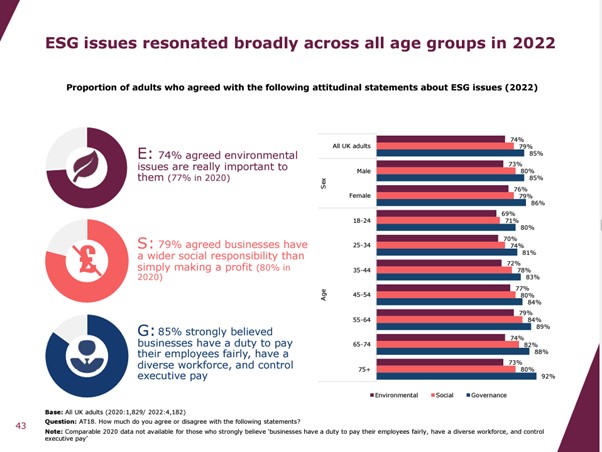

Some of the key stats highlighting general interest are:

- 74% agreed environmental issues are really important to them (77% in 2020)

- 79% agreed businesses have a wider social responsibility than simply making a profit (80% in 2020)

- 85% strongly believed businesses have a duty to pay their employees fairly, have a diverse workforce, and control executive pay

The research also indicates that awareness of responsible investment is growing:

- 23% are ‘very aware’ – up from 16% in 2020

And that this is also a growing opportunity – in other words we there is work to be done if we are to meet clients personal preferences better (the stats are pretty consistent across different age groups and other segments).

- Among adults with pensions or investments, 62% were interested in investing in Responsible Investments in the future – up from 57% in 2020.

Research also indicated that (unsurprisingly) those most likely to have invested in responsible investment already are people with higher levels of money to invest:

- Among adults with pensions or investments, 9% (3.1m) had chosen to invest in Responsible Investments at some point, rising to 23% for those with £250k+ in investible assets (differences are a function of wealth not age or sex), only a minority agreed they might be prepared to pay more (36%) or accept higher risk (37%) although that number rose significantly (to only 14% not willing to pay

This section went on to add that – only a minority of respondents agreed they ‘might’ (very or somewhat) be prepared to pay more (36%) or accept higher risk (37%) to invest responsibly – although that number rose very significantly – to only ‘14% NOT willing to pay more’ – when presented with a real life example. This points, to the benefit of not only client’s seeking advice, but also making sure people understand what funds of this kind are really about… although the subsequent slide indicated that we remain some way from achieving that as people continue to find it difficult to decide which funds were and were not ‘responsible’. (My hope is that the SDR will help move that one in the right direction!!)

https://www.fca.org.uk/financial-lives/financial-lives-2022-survey

Importantly this is supported by ONS research carried out in September/October in 2022 also, which also indicates high interest in the issues underpinning sustainable investment:

eg:

- Around three in four adults (74%) reported feeling (very or somewhat) worried about climate change; the latest estimate is similar compared with the percentage who said they felt worried (75%) around a year ago.

- Around 1 in 10 people (9%) felt unworried (somewhat unworried or not at all worried) about climate change, higher than a year ago when it was 6%, and around one in five (17%) said they were neither worried nor unworried.

- Thinking there are more urgent priorities to be worried about was the most frequently reported reason among those who were unworried or neither worried nor unworried about climate change (55%, up from 34% around a year ago).

- When asked about a range of issues, climate change was the second biggest concern facing adults in Great Britain (74%), with the rising cost of living being the main concern (79%).

https://www.ons.gov.uk/peoplepopulationandcommunity/wellbeing/articles/worriesaboutclimatechangegreatbritain/septembertooctober2022

Further FCA information is available via the following links:

- https://www.fca.org.uk/publication/financial-lives/financial-lives-survey-2022-key-findings.pdf

- https://www.fca.org.uk/data/financial-lives-2022-early-survey-insights-vulnerability-financial-resilience

- https://www.fca.org.uk/publication/financial-lives/fls-2022-consumer-investments-financial-advice.pdf

Additional external research published by FCA: