SDR update – a whistlestop tour for financial advisers

Posted on: July 19th, 2024

As we welcome the sun putting in an appearance at long last, and before everyone heads off on their holidays, I’d like to share a few thoughts on how SDR is going, what you might expect and how to get involved.

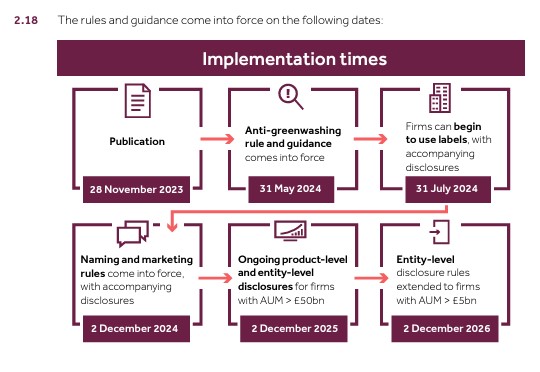

The FCA’s sustainability disclosure and labelling rules went live in November and 31st July is the first date fund managers will be allowed to use the new SDR fund labels.

I’d like to manage your expectations however, as I’m pretty confident there won’t be hundreds of funds using the new labels at that point. What is more likely is that fund labels will start appearing at that time and gradually increase up to the end of the year.

The reason this is going more slowly than we might have hoped is essentially because this is new to everyone.

The FCA fund approval team in particular seem to be working through how the combination of being ‘principles based, client friendly and sufficiently precise in order to ensure information is meaningful’ should work, for example.

The area of broad-based sustainable funds, which most of us probably call ‘sustainable funds’, seems to be proving particularly challenging. These are the forward-looking funds, typically managed by deeply committed inhouse teams, that cover pretty much anything the individual investor with an interest in sustainability might hope. The issues they cover range from avoiding fossil fuel companies through to encouraging net zero transition plans – via supply chain management, impact measurement, SDG mapping, blue bonds and much more. The opportunities and variation are almost limitless.

The bottom line is that regulating this on a granular level is tough, not only because pretty much every aspect of our lives is unsustainable and no company is 100% perfect, but also assets are bought and sold.

The area that’s worrying financial advisers, portfolio managers, platforms and others rather more at present is the new anti-greenwash rule. What we appear to be seeing is people who previously didn’t recognise sustainability was in scope of the long standing ‘clear, fair and not misleading rules’ getting stressed, but they are not alone.

One of the slightly perverse things I’ve noticed is that the better companies are at sustainability the more they seem to be worrying. My general recommendations include, avoiding blanket assertions (as nothing is perfect), and to run marketing materials past people who know and care about sustainability and sustainable investment (they are often better placed to judge what is and is not at risk of being an exaggerated claim than many compliance folk). People should also be wary of what some call ‘lonely numbers’ – data points that can be easily misinterpreted because they lack context (eg is ‘75% of assets aligned to sustainability objectives’ good or bad??*).

Issues such as this are why we have spent many years encouraging fund to publish more specific information – and indeed why we run the (free to use) Fund EcoMarket database with its many fund filter options.

We also run events for advisers and wealth managers. Our next big bash will be our annual Good Money Week event in October (at the Museum of London). The FCA’s Director of ESG, Sacha Sadan, will be giving the keynote address and has kindly agreed to take questions. Please join us on the day, armed with questions!

In the meantime, have a lovely summer, and I hope to see you in October!

*(75% is okay, but not amazing, in my view. It meets the labelling requirements, but it depends what assets the fund holds and, for example the proportion of revenue derived from environmental and social solutions, and what a client wants… amongst other things!)

Julia Dreblow

Founder SRI Services and Fund EcoMarket

Links:

Database link: https://www.fundecomarket.co.uk/fund-ecomarket/