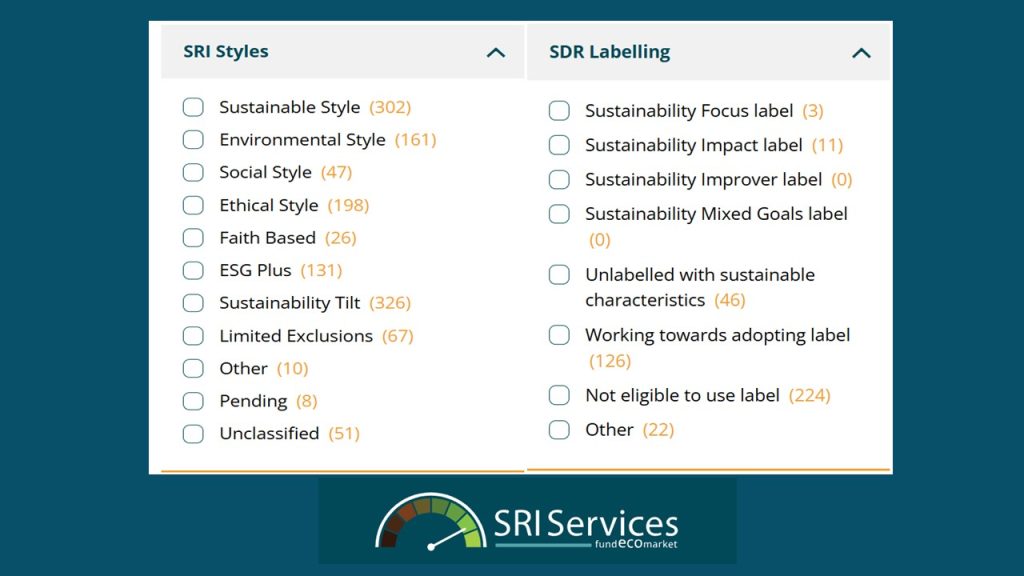

Mapping SRI Styles to SDR labels

Posted on: January 13th, 2025

SRI Styles relationship with SDR labels

Our SRI Styles are different from the FCA’s SDR labelling regime. They predate the regime by over a decade and serve a different purpose.

The styles give a flavour of both the lead ‘issue/s’ a fund focuses on (sustainable, environmental, social, ethical, faith) and the funds ‘approach’ ie the way in which issues are integrated into asset selection (ESG Plus funds and Sustainability Tilted funds tend to be less strictly screened/themed and Limited Exclusion tend not to have extensive sustainability strategies).

Our approach is different from SDR (explained in our earlier blog and here) but other key factors are that SDR labels can only be adopted by UK domiciled funds at present – so the number of funds will be far smaller than the total Fund EcoMarket cohort for some time. In addition SDR labelling remains somewhat ‘work in progress’ – many reputable funds are still in the process of applying to use labels – and many good have decided not to use a label for a range of reasons – including implementation issues.

Mapping our SRI Styles to SDR

Sustainability Style – we expect most funds of this kind to be broadly in line with the SDR labelling regime requirements (although funds may be ineligible or unwilling to adopt labels at this time)

Environmental Style – we expect many funds of this kind to be broadly in line with the SDR labelling regime (although funds may be ineligible or unwilling to adopt labels at this time)

Social Style – we expect many funds of this kind to be broadly in line with the SDR labelling regime (although funds may be ineligible or unwilling to adopt labels at this time)

Ethical Style – we believe many funds of this kind will be suitable for clients with an interest in sustainability however because of the design of the labelling regime most are unlikely to meet the labelling criteria – so may tend to opt for ‘Unlabelled with sustainability characteristics’ option, or be referred to as ineligible/other..

Faith Style – funds of this kind are unlikely to be aligned to SDR

Sustainability Tilted funds – some funds of this kind may be suited to SDR, although others may not. For managers who decide to adopt a label the most likely label would be the ‘Improver’ as selection tends to be less strict than some other styles.

ESG Plus – some funds of this kind may be suited to SDR, although others may not. For managers who decide to adopt a label the most likely label would be the ‘Improver’ as selection tends to be less strict than some other styles.

Limited Exclusions – funds of this kind are not likely to be aligned to the SDR labelling regime.

Further information

- Our SRI Styles Directory explains the our fund classifications further

- Our SDR Support page explains more about the new FCA regime

- See our blogs and articles for more detailed information about SDR.

- Search funds by SRI Style or SDR label on our database