Note – this page is liable to change regularly at present.

What is SDR?

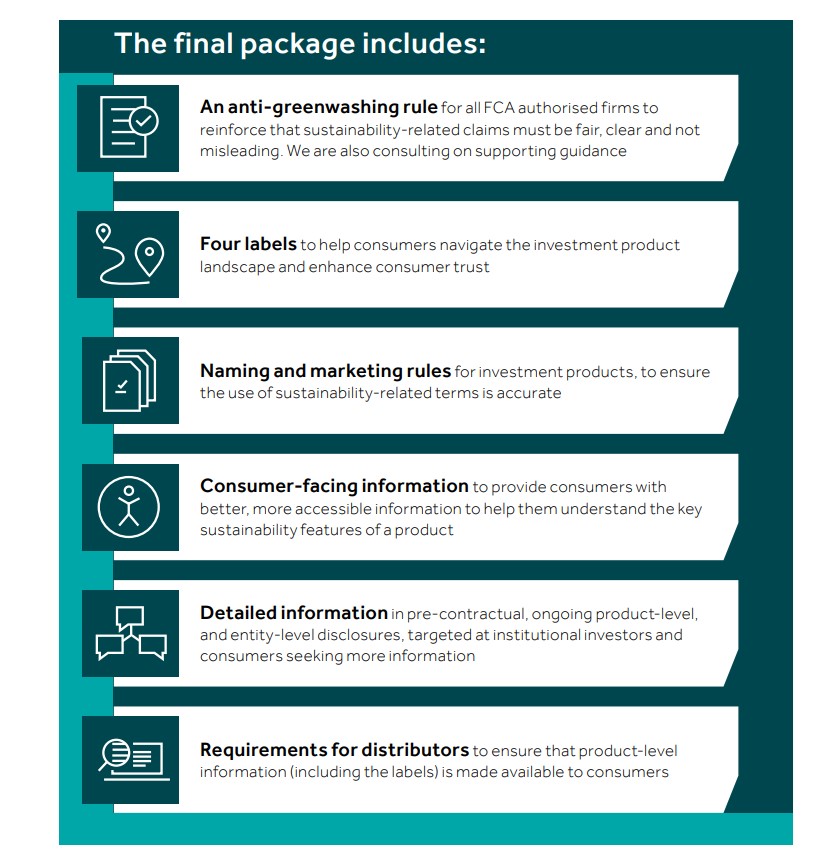

The FCA’s Sustainability Disclosure Requirements (SDR) and investment labels regime (PS 23/16) is a package of measures introduced in November 2023. The new rules are primarily designed to improve transparency and trust in UK based retail funds that are promoted as having sustainability (and related) strategies.

Its core elements are:

Scope and coverage of the new SDR labelling regime.

Much of SDR is now up and running (eg the anti greenwash rule), however the labelling regime is still somewhat ‘work in progress’.

The labelling regime is not only optional, but also does not yet apply to all relevant retail fund and product areas.

For example, the rules for portfolio managers and offshore funds are not yet known but are expected to follow in 2025. Life and pension funds are also not yet in scope.

There are also funds that we expect to receive labels that have not yet been approved by the FCA implementation team, and some highly reputable funds that have decided not to adopt a label because of how the labelling rules are being implemented. (The FCA’s approach has caused issues for a number of highly regarded funds as it is far more prescriptive than expected.)

We expect this area to evolve over time and remain hopeful that teething issues will be worked through, and for now encourage our site users not to rely on labels alone.

Where can I find further information on SDR?

We have been keeping tabs on SDR developments on our blogs, which include both FCA news and our own commentary.

The most important current links to FCA information are listed below:

- The FCA’s SDR Policy Statement is linked here ( PS23/16: Sustainability Disclosure Requirements (SDR) and investment labels | FCA) – published on 28 November 2023.

- There is a lot happening in SDR and related areas at the moment. We track these in our blog area, using the ‘SDR’ tag.

- The FCA is publishing additional updates here FCA’s responses to SDR queries

- FCA ESG Handbook ESG Handbook includes more specific information.

- About Greenwash – link to FCA anti-greenwash announcement and portfolio consultation link (April 2024)

- Client facing label information (to be published by relevant fund providers – follow link)

- Information about the Adviser Sustainability Group

What information do we we publish about SDR fund labels?

We remain supportive of the SDR labelling regime, whilst recognising that it’s implementation is not yet working as intended.

As such we are publishing extensive SDR related information both via our filter options and within individual fund entries – as applicable.

In brief – for our filter options we ask fund managers whether or not they have adopted a label – and if so which one – and if not – we ask them to select from other options so that users can see why no label is in use. ( See SDR filter field.)

What can you use Fund EcoMarket to do?

- generate a list of funds that have chosen to adopt an SDR label, as well as identify reasons why potentially relevant funds do not have a label

- See SDR related literature links within individual fund entries that have labels (and any additional comments, where supplied)

Fund EcoMarket is free to use thanks to our fund manager partners (funds listed first with logos).

The ‘SDR labelling’ filter is in the ‘Fund Basics’ section of the Fund EcoMarket database.

SDR Presentations & Videos

We discussed SDR extensively at our most recent conference, on 3 October 2024.

This included presentations from the FCA’s Director of ESG Sacha Sadan and three groups of fund managers exploring different aspects of the new rules.

See SDR presentations and panels discussions here.

In January 2024 we also published a brief introduction to the new rules:

How do our SRI Styles ‘map’ to the SDR Labels?

Our SRI Styles are different from the FCA’s SDR labelling regime and predate the regime by over a decade.

The styles give a flavour of both the lead ‘issue/s’ a fund focuses on (sustainable, environmental, social, ethical, faith) and the funds ‘approach’ ie the way in which issues are integrated into asset selection (ESG Plus funds and Sustainability Tilted funds tend to be less strictly screened/themed and Limited Exclusion tend not to have extensive sustainability strategies).

In addition, SDR only applies to a limited number of UK domiciled products at present – so the number of funds will be far smaller than the total Fund EcoMarket cohort for some time. Users should also note that SDR remains ‘work in progress’ (many funds are still in the process of applying to use labels) and many good have opted out of the regime for various reasons – including implementation issues.

Please be aware however that this is a fast changing situation at present and the following are simply our opinions, this will continue to evolve…

Mapping our SRI Styles to the FCA’s SDR labelling regime

Sustainability Style – we expect most funds of this kind to be broadly in line with the SDR labelling regime – although funds may be ineligible or unwilling to adopt labels at this time. These are most likely to be Focus or Impact labels, depending on their strategy.

Environmental Style – we expect many funds of this kind to be broadly in line with the SDR labelling regime – although funds may be ineligible or unwilling to adopt labels at this time. These are most likely to be Focus or Impact labels, depending on their strategy.

Social Style – we expect many funds of this kind to be broadly in line with the SDR labelling regime – although funds may be ineligible or unwilling to adopt labels at this time. These are most likely to be Focus or Impact labels, depending on their strategy.

Ethical Style – we believe many funds of this kind will be suitable for clients with an interest in sustainability however because of the design of the SDR labels most are unlikely to meet the criteria so may opt for ‘Unlabelled with sustainability characteristics’, or be referred to as ineligible.

Faith Style – funds of this kind are unlikely to be aligned to SDR

Sustainability Tilted funds – some funds of this kind may be suited to SDR, although others may not. For managers who decide to adopt a label the most likely label would be the ‘Improver’ as selection tends to be less strict than some other styles.

ESG Plus – some funds of this kind may be suited to SDR, although will may not. For managers who decide to adopt a label the most likely label would be the ‘Improver’ as selection tends to be less strict than some other styles.

Limited Exclusions – funds of this kind are not likely to align to the SDR labelling regime typically because of their lack of positive focus.

Please note the comments above do not indicate ‘suitability’ – users are recommended to use individual fund and fund manager filters to match client aims to fund or product options.

(Further commentary to follow.)

Other relevant compliance links:

- PRIN 2A

- Overseas fund regime update July 2024

- FCA ESG Handbook – (sourcebook updated post SDR) eg:

-

- 5.1, 5.2 & 5.3 Preparation of sustainability disclosures

- 5.4 Labels

- 5.5 Sustainability product reporting

- FCA welcomes ESG ratings and data provider code of conduct December 2023

- FCA Regulatory Initiatives Grid 30 November 2023

- FCA Financial Lives Survey (2022 FLS)