Introduction to SDR

The FCA’s Sustainability Disclosure Requirements (SDR) and investment labels regime (PS 23/16) is a package of measures – introduced in November 2023, having initially been ‘socialised’ in November 2021 in the UK government’s ‘Sustainable Investing Roadmap’.

The rules are primarily designed to improve transparency and trust in UK based retail funds that are promoted as having sustainability (and related) characteristics and strategies.

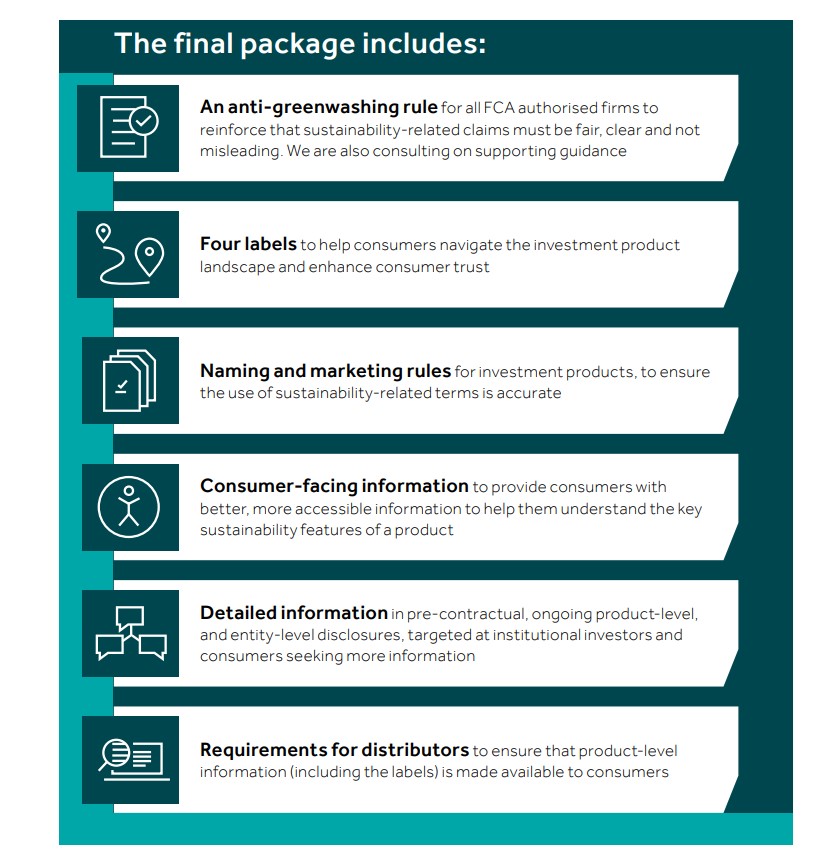

Its key elements are shown in the graphic below (source SDR):

Understanding the new SDR rules:

The following is our understanding of the key aspects of the rules. See below for links to the FCA website.

What is SDR?

SDR is a package of interconnected measures designed to ensure individual investors have access to reliable, decision-useful sustainability information.

SDR is the result of a number of different aims, which the FCA describes as SDR’s three core intended outcomes (see SDR PS23/16 figure 1).

Note: In April 2025 the FCA announced that plans to extend SDR to portfolios had been paused.

The core aims can be summarised as intending to:

- Address greenwash in order to protect clients

- Increased sustainability information – to protect markets

- Consumers to make use of sustainable fund labels in order to improve competition

SDR comprises six new sets of requirements:

- Anti greenwashing rule. The anti-greenwash rule requires any references to the sustainability characteristics to be consistent with the sustainability characteristics of the product or service and for communications to be ‘clear, fair and not misleading’. FG24/3 explains further – and includes examples, including reference to the need for references to be correct, clear, complete and able to be compared. See ‘Sustainability references should be:’ FCA image.

- Labels. From July 2024, in-scope funds that ‘intentionally’ focus on positive environmental and or social outcomes can choose to adopt one of four sustainability labels, subject to certain disclosure requirements. Broadly similar funds should indicate if they have chosen not to use a label (and meet certain rules).

- Naming and Marketing rules. Only funds that have adopted an SDR label can now have ‘sustainable’, ‘sustainability’ or ‘impact’ in their name. Similar terms (responsible, environmental etc) can be used, but must only be used to accurately describing alignment to fund activities – to guard against potentially misleading clients. This has led to many fund names being changed.

- Consumer facing information. Managers of labelled funds (and similar) must publish a two-page client friendly summary of the fund’s sustainability strategy. These new ‘Consumer Facing Documents’ (CFDs) have prescribed content. Unlabelled funds with significant environmental or social characteristics must also supply CFDs.

- Detailed information. Detailed pre-contractual sustainability information must be available – typically in a fund’s prospectus. Additional comprehensive fund and fund management entity level disclosures will also be required from late 2025 and 2026.

- Requirements for distributors. Distributors, such as platforms, are required to show which funds are labelled, with links to required information (CFDs and FCA labels page). This rule covers advisers also – the format is non prescriptive.

SDR Labelling basics

Funds must meet specific requirements in order to use an SDR sustainability label. Some rules apply to all of the labels, others apply to individual labels. The rules allow for significant strategy variations, but all require a labelled fund to be focused on intentionally delivering positive environmental or social (sustainability) outcomes. Key points of note include:

- Only ‘in scope’ funds can opt to use an SDR label.

- Labelled funds must aim to help deliver positive real world sustainability outcomes

- SDR does not dictate fund sustainability strategies. A fund may focus on a single environmental or social issue, of all sustainability issues.

- Processes may be proprietary or aligned to an external service (such as an index) – however in either situation the fund manager is responsible for the strategy.

- Labels are optional. Funds can also be ‘Unlabelled with sustainability characteristics’. Additional disclosures are required for both.

- Labels are not ‘approved’ by the FCA, however amends to pre-contractual disclosures – typically in a prospectus – are typically required.

- Labelled funds must produce two page client facing disclosure documents

- Labelling funds must aim to deliver positive environmental and or social outcomes (and the need for evidence)

- At least 70% of a labelled fund’s assets must to align to the fund’s objectives – (fund managers must explain how this works in practice)

- No labelled fund assets should conflict with the fund’s sustainability objectives

- Strategies must be verified; however this can be done internally (subject to the verifier being independent of the process) or by a third party.

- Stewardship strategies to include escalation plans

- Specific rules apply to each label (see below)

Requirements for all labelled funds indude:

All funds that chose to adopt an SDR label are required to publish the following:

- Sustainability objectives

- Documented sustainability policies/strategies

- Sustainability KPIs

- Appropriate resources and governance

- Stewardship strategies

SDR labels – key differences

In scope funds that focus on positive environmental and or social outcomes may choose to use one of the following four labels:

Sustainability Focus – these funds are required to publish ‘robust evidence-based standards that are an absolute measure of environmental and or social sustainability’.

Sustainability Improvers –funds that invest in assets that have the potential to improve their environmental and or social standards over time. These will typically lean in to stewardship activity more than funds with other SDR labels. An asset’s path to improvement must be credible. Robust evidence is required.

Sustainability Impact – this label is for funds with a pre-defined focus on the delivery of positive, measurable environmental and or social impacts. These funds must also have a ‘theory of change’ that describes how the product (eg fund) and, or its assets, will deliver positive impacts, using a robust measurement methodology.

Sustainability Mixed Goals – for in scope funds that combine two or more of the above approaches.

In scope funds that have a significant emphasis on sustainability may chose not to use a label. In which case they may be referred to as ‘Unlabelled with sustainability characteristics’ (or similar) . These funds must publish disclosures similar to those required for labelled funds.

See the FCA’s SDR document PS23/16 and the FCA’s ESG Handbook for further information and to keep up to date with any possible changes.

What should advisers and other intermediaries do differently now?

Distributors are required to share SDR labels, relevant documentation (eg CFDs) and a link to FCA labelling information.

The FCA has not prescribed how this should be done or the format, however the purpose is to ensure clients receive this information – so different methods are likely to suit different business models.

Our site has been updated to provide the source information intermediaries need. The filter options show fund’s labelling status, and individual fund entries contain CFDs and links to fund websites.

Note – the FCA does not publish a list of labelled funds.

See below for additional regulatory links.

To help intermediaries make use of SDR (and share relevant information with clients -as required) we publish SDR related fund information.

The Fund EcoMarket database has a filter field that shows individual fund status (in scope and out of scope).

New text fields within fund entries includes links to Consumer Facing Documents (CFD’s) and additional information – where applicable.

Additional information:

We discussed SDR extensively at our most recent conference, on 3 October 2024.

This included presentations from the FCA’s Director of ESG Sacha Sadan and three groups of fund managers exploring different aspects of the new rules.

See 3 October 2024 SDR presentations and panels discussions here.

We also published a brief introduction to the new rules in January 2024:

How can Fund EcoMarket help users with SDR information?

Fund EcoMarket enables you to:

- generate a list of funds that have chosen to adopt an SDR label, that have chosen not to use a label, or are not in scope. (Note – funds may chose not to publicise a label immediately).

- find SDR related literature links within individual fund entries for funds that have labels (plus any additional comments, where supplied)

Fund EcoMarket is free to use thanks to our fund manager partners (funds listed first with logos).

The ‘SDR labelling’ filter is in the ‘Fund Basics’ section of the Fund EcoMarket database.

Our SRI Styles and filters are different from – but compliment SDR labels

Our SRI Styles are different from the FCA’s SDR labelling regime. They predate the regime by over a decade.

The styles give a flavour of both the lead ‘issue/s’ a fund focuses on (sustainable, environmental, social, ethical, faith) and the funds ‘approach’ ie the way in which issues are integrated into asset selection (ESG Plus funds and Sustainability Tilted funds tend to be less strictly screened/themed and Limited Exclusion tend not to have extensive sustainability strategies).

In addition, SDR only applies to a limited number of UK domiciled products at present – so the number of funds will be far smaller than the total Fund EcoMarket cohort for some time. Users should also note that SDR remains ‘work in progress’ (many funds are still in the process of applying to use labels) and many good have opted out of the regime for various reasons – including implementation issues.

Please be aware however that this is a fast changing situation at present and the following are simply our opinions, this will continue to evolve…

How do our individual ‘SRI Styles’ map to the FCA’s SDR labelling regime?

- Sustainability Style – we expect most funds of this kind to be broadly in line with the SDR labelling regime – although funds may be ineligible or unwilling to adopt labels at this time. These are most likely to be Focus or Impact labels, depending on their strategy.

- Environmental Style – we expect many funds of this kind to be broadly in line with the SDR labelling regime – although funds may be ineligible or unwilling to adopt labels at this time. These are most likely to be Focus or Impact labels, depending on their strategy.

- Social Style – we expect many funds of this kind to be broadly in line with the SDR labelling regime – although funds may be ineligible or unwilling to adopt labels at this time. These are most likely to be Focus or Impact labels, depending on their strategy.

- Ethical Style – we believe many funds of this kind will be suitable for clients with an interest in sustainability however because of the design of the SDR labels most are unlikely to meet the criteria so may opt for ‘Unlabelled with sustainability characteristics’, or be referred to as ineligible.

- Faith Style – funds of this kind are unlikely to be aligned to SDR

- Sustainability Tilted funds – some funds of this kind may be suited to SDR, although others may not. For managers who decide to adopt a label the most likely label would be the ‘Improver’ as selection tends to be less strict than some other styles.

- ESG Plus – some funds of this kind may be suited to SDR, although will may not. For managers who decide to adopt a label the most likely label would be the ‘Improver’ as selection tends to be less strict than some other styles.

- Limited Exclusions – funds of this kind are not likely to align to the SDR labelling regime typically because of their lack of positive focus.

Please note the comments above do not indicate ‘suitability’ – users are recommended to use individual fund and fund manager filters to match client aims to fund or product options.

Where can I find further information on SDR?

We aim to keep tabs on SDR developments via our blogs, which include both FCA news and our own commentary.

The most important current links to FCA information are listed below:

- The FCA’s SDR Policy Statement is linked here ( PS23/16: Sustainability Disclosure Requirements (SDR) and investment labels | FCA) – published on 28 November 2023.

- There is a lot happening in SDR at present. We aim to track these in our blog area, using the ‘SDR’ tag.

- The FCA is publishing additional updates here FCA’s responses to SDR queries

- FCA ESG Handbook ESG Handbook includes more specific information.

- February 2025 update – Handbook Notice 127 here.

- About Greenwash – link to FCA anti-greenwash announcement and portfolio consultation (April 2024)

- Client facing label information (to be published by relevant fund providers – follow link)

- Information about the Adviser Sustainability Group

- Pre contractual disclosure FCA guidance

Other relevant compliance links:

- PRIN 2A

- Overseas fund regime update July 2024

- FCA ESG Handbook – (sourcebook updated post SDR) eg:

-

- 5.1, 5.2 & 5.3 Preparation of sustainability disclosures

- 5.4 Labels

- 5.5 Sustainability product reporting

- FCA welcomes ESG ratings and data provider code of conduct December 2023

- FCA Regulatory Initiatives Grid 30 November 2023

- FCA Financial Lives Survey (2022 FLS)